Lithium is in high demand worldwide for the production of rechargeable batteries used in the rapidly expanding electric vehicle (EV) and utility- scale energy storage markets, as well as a plethora of everyday mobile devices. The problem is, there are relatively few places on the planet that offer rock formations or naturally occurring underground brine reservoirs conducive to the economic production of lithium — and even there the concentrations of lithium in the rock and brine are measured in parts per million. Now, a handful of companies in Alberta and elsewhere are exploring the potential for “direct lithium extraction” from oil and gas well brine, an alternative technique that some view as a potential breakthrough. In today’s RBN blog, we discuss the promise — and potential pitfalls — of lithium production from oil and gas brine.

They seem to be with us wherever we go — or don’t go — these days. Our digitized, wireless and cordless world has produced billions of devices in the form of smartphones, laptops, tablets, drills, grass trimmers, lawn mowers and, yes, even EVs, all of which are becoming so commonplace that we do not even seem to notice them anymore. You might be able to quickly come up with at least a couple of dozen other examples, but they all have something in common: rechargeable batteries that allow them to be used on the go without the fuss of being constantly plugged into an electric outlet or relying on a hydrocarbon- based fuel as part of an internal- combustion process. Also, utility- scale energy storage has been catching on in a big way — it involves series of massive, rechargeable batteries that sock away (mostly) renewable energy for use when demand peaks.

The steadily evolving energy transition will require a tremendous deployment of rechargeable batteries, especially for the rapidly increasing production of EVs as well as the power stations intended to balance renewable generation with load. The batteries that make it all possible likely contain lithium, one of the most in- demand metals on the planet and, so far, one of the best substances known to hold an electric charge for a reasonable length of t ime and be recharged almost as many t imes as needed.

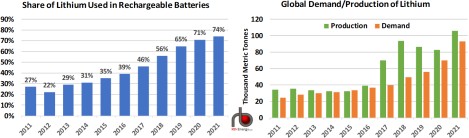

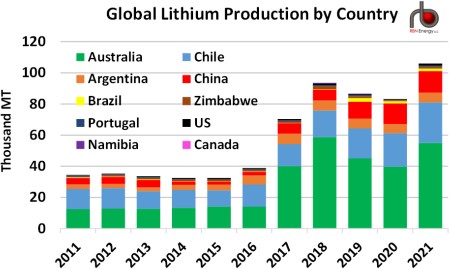

Based on data from the U.S. Geological Survey’s (USGS) Annual Mineral Commodity Summaries, use in batteries constituted 74% of all lithium demand in 2021, up from a 39% share in 2016 and 27% in 2011 (left chart in Figure 1). Excluding U.S. output, which the USGS does not disclose, global production of lithium from all other countries has risen from 34,000 metric tons (MT) in 2011 to the USGS estimate of more than 100,000 MT in 2021 (green bars in right chart). Data from the Nevada Division of Minerals (NDM) reports lithium production of 1,160 MT in 2021, up from 759 MT in 2016 and well above the 271 MT produced in 2011. (The only active U.S. lithium production facility is in Nevada.) That would put U.S. production of lithium at less than 1% of global output. (Note that we have added in the NDM’s estimate of US lithium production to the charts in Figure 1.)

Figure 1. Share of Lithium Used in Rechargeable Batteries and Global Demand/Production of Lithium.

Source: USGS

The USGS also estimates that global demand for lithium (orange bars in right chart) was 93,000 MT in 2021, up from 36,700 MT in 2016 and 24,600 MT in 2011. Based on the data in both charts, the amount of lithium being used in batteries has increased an astounding 10x in that 10- year t imeframe (from 6,640 MT to 68,820 MT), with most of that increase coming from lithium- ion batteries to be used in EVs.

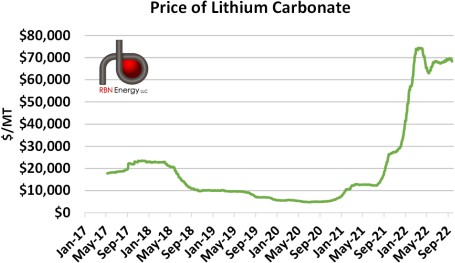

The enormous expansion in production in 2017 relative to demand led to an oversupply of lithium carbonate, a precursor to lithium (more on this below), and a rapid reduction in lithium carbonate prices (Figure 2). Prices have undergone a rapid increase this year as much of the backlog was cleared from the market by rising demand. Though not disclosed by producing nations, we suspect that much of the difference between production and demand in the years 2017 to 2020 found its way into either commercial or, more likely, government- controlled stockpiles of lithium carbonate, especially given lithium’s increased importance.

Figure 2: Price of Lithium Carbonate. Source: Investing.com

With many countries passing legislation that would ban the sale of internal- combustion engine (ICE) vehicles as early as 2030, the demand for lithium- based batteries for use in EVs is only going to increase manyfold again within the next decade. You can get a better sense for the monumental task involved for the many kinds of metals that will be in heavy demand for the energy transition — including lithium — in our four- part Tell It Like It Is (https://rbnenergy.com/tell-it-like-it-is-unseen-costs-of-the-energy-transition-materials-metals-and-construction-materialsenerener) series. One of the significant conclusions of that series is that there may not ever be enough of these metals to satisfy all the demand created by an all- out transition to EV production. Keeping in mind this potentially sobering limitation, there does seem to be a bright future for lithium and for as much production as possible of the stuff, even if only some portion of expected future demand can be satisfied.

Lithium in its pure form is very rare in nature and is typically bound with other minerals. It is most commonly produced from one of two techniques: the extraction of lithium- containing salts from underground brine reservoirs or the mining of lithium- containing rock such as spodumene. Lithium in its pure form can quickly deteriorate due to oxidization with the atmosphere and is only produced at the very end of the process, when it is wrapped in paraffin wax prior to being purposed for manufacturing into items such as rechargeable batteries. As such, both of the production processes focus on an intermediate product one step removed from pure lithium known as lithium carbonate, mentioned earlier, a stable white powder that can be more easily stored or shipped before being chemically treated to yield pure lithium. There is also production of lithium hydroxide, which is often favored over lithium carbonate due to its even more stable characteristics and higher durability when used in battery production. However, its production costs are typically higher, leaving lithium carbonate as the preferred channel for eventual lithium production.

Check out RBN's Clust erX EMF Channel Live Cells

Producing lithium carbonate from underground brine reservoirs involves pumping the extremely salty water brine to the surface, where it is deposited in large evaporation ponds. Over a period of months, the brine slurry dries to the point where the lithium- containing salts can be more easily collected and further chemically treated to yield lithium carbonate. The salts can have a lithium concentration ranging from several hundred to as high as 7,000 parts per million (ppm) — many say those concentrations are too low to support economic recovery of lithium, but others take a more optimistic view. (More on this in a moment.) As you might expect, evaporation ponds large enough to yield the harvesting of economic amounts of lithium rich salts consume a large land footprint and also require a significant amount of fresh water in the process to produce lithium carbonate. This can be a contentious issue is the high desert climates where these ponds are located.

The other, more conventional means for producing lithium — the mining of spodumene rock — involves the harvesting of rock from underground or open- pit mines. After the rock is crushed, it undergoes a cycle of extreme heating and rapid cooling, with additional treatment with sulfuric acid and sodium carbonate to yield lithium carbonate. Lithium yields from mining can be higher than production from brine, but the mining- based production process is also more costly and energy intensive.

Figure 3. Global Lithium Production by Country. Sources: USGS, Nevada Division of Minerals

There are only a handful of lithium- producing countries (Figure 3 above), with Australia (green bar segments) being the dominant supplier, as it has been for a number of years through its mining operations, followed by Argentina (orange segments), Chile (light- blue segments) and China (red segments), all three of which more widely utilize the brine- evaporation process. (So does the U.S.’s only lithium facility in Nevada.) With what seems to be a near- insatiable appetite for lithium in the years ahead, it would seem to only make sense for production from existing suppliers to expand as rapidly as possible, and for new suppliers to join the fray. However, there is that nasty problem of potential environmental impacts associated mine sites, evaporation ponds and fresh water use, something that aspiring lithium producers are looking to avoid.

Although Canada has undertaken spodumene mining operations in the past in the provinces of Ontario and Quebec, the results to date have been very small in scope and the production economics remain challenging. There are some signs that mining operations might be revived, but scale and cost remain a concern.

This is where Alberta, Canada’s largest oil and gas producer, might be able to make a big splash — without actually using evaporation ponds. The key is oil and gas well brine — and a new approach. For decades, the super- salty water has been pumped to the surface as part of oil and gas production, with the unwanted brine mix typically being reinjected in disposal wells and the associated expense viewed as a cost of doing business in Alberta’s oil and gas sector. It has also been known for a long time that this brine contains various useful substances — such as lithium — but in concentrations far smaller than in the brines used by major brine- based lithium producers in Argentina, Chile and China. Moreover, there has been no appetite to construct evaporation ponds to produce low- concentration, lithiumcontaining salts from oil and gas well brine, yielding the whole process not only land- disturbing, but uneconomic.

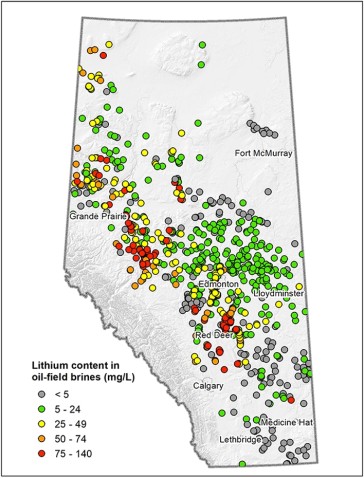

Wells that have produced brine and geologic reservoirs that still contain their original unproduced brine have been actively mapped across Alberta as part of its oil and gas business. Additional work has been carried out by the Alberta Geological Survey (AGS) to determine the areas of the province where lithium concentrations might be more favorable for some form of brine- lithium production (clusters of red dots in Figure 4). However, the sampled lithium concentrations in the brine are still much lower than those brines being utilized in other parts of the world, possibly rendering Alberta brine- based lithium production nonviable from an economic perspective.

Figure 4. Alberta Lithium Distribution and Concentrations. Source: AGS

Looking to take advantage of what could be an enormous brine resource, a third lithium- extraction technique, dubbed direct lithium extraction (DLE), is being explored in Alberta to determine if it might be able to overcome the disadvantages of low lithium concentrations and minimize land disturbance. Several various proprietary processes are being developed, but they essentially involve pumping brine to the surface from a known brine reservoir or, ideally, an already producing oil or gas well, and passing the brine mix through a solution that is amenable to binding with the lithium in the brine (Figure 5). The lithium- containing solution is then extracted, with the remaining brine reinjected as waste.

Figure 5. Schematic of Direct Lithium Extraction. Source: E3 Lithium

DLE’s advocates claim it has advantages in that the process only takes minutes for the lithium extraction to take place (as opposed to months for an evaporation pond or days for a mine site), does not disturb any more land than what was used by the original oil/gas producing well and reinjection well, minimizes or eliminates fresh water use, and can quickly concentrate the lithium to levels where it can be processed into lithium hydroxide (rather than lithium carbonate), which is more amenable for use in rechargeable battery production while also being less energy intensive than mining operations. Numerous Alberta start- ups are selecting sites where they can test their specific DLE process before moving forward with larger- scale commercial operations and, with so many advertised advantages, the idea would seem to hold a lot of promise.

However, there are reasons that this process hasn’t been widely adopted and implemented yet. First, as we noted at the outset, the low concentration of lithium in the brine means that a lot of brine must be treated, which can be challenging to economics. Further, we’ve heard that it can be difficult and expensive to completely remove any hydrocarbons that may still be in the brine, which makes it incompatible with existing processes for DLE and electrolytic refining.

We should point out that the concept of DLE is not unique to Alberta and the technology is being tested in many other parts of the world, including the neighboring oil and gas producing province of Saskatchewan. However, Alberta's vast brine resources are being diligently pursued through a combination of new legislation and taking advantage of the province’s long- established process for dealing with oil- and gas- producing wells or abandoned wells that might be re-tapped for lithium production. In late 2021, the province passed its new Mineral Resources Development Act to better define the production process around mineral resources and bring lithium production under the purview of the Alberta Energy Regulator (AER), the province’s traditional regulator of the oil and gas sector. Additional legislative work is being considered to deal with other concerns for the budding lithium industry.

Alberta already has a vast pool of experienced workers that know oil and gas production and wastewater- disposal techniques, the very people that are well qualified to continue operating existing wells or restart previously abandoned wells for brine/lithium production. With at least tens of thousands of abandoned wells and many more actively producing, finding brine is not a problem. Rather, it is finding those wells and regions of the province where brine can be tapped in an economic way and new lithium production techniques applied. At higher levels of government, Canada and the U.S. finalized a joint action plan in January 2020 to collaborate on securing supply chains for critical minerals, including lithium. In April this year, President Biden invoked the Defense Production Act to bolster support for the domestic production of minerals, including lithium, used in EV batteries and other energy storage devices.

Several of Alberta’s budding lithium producers are aiming to have commercial- scale operations up and running by 2025, with at least one company boasting that it could be producing 20,000 MT of lithium hydroxide by then, roughly the equivalent of 5,800 MT of lithium. (This would place it in the same league as the brine- based operations in Nevada.) Multiply that by several other Alberta companies and, if the hype turns out to be real, annual production of lithium in the province could surpass 10,000 MT later this decade, placing it ahead of several other smaller- scale producers such as Argentina, Brazil and Portugal.

There is still along way to go before any commercial- scale production of lithium gets underway in Alberta, and keep in mind that many doubt the economics of lithium production from oil and gas brine. The fact is, though, that lithium supply will need to increase exponentially in the coming years, and not pursuing every possible approach to lithium production would be the “crime of the century.”

“Crime of the Century” was written by Rick Davies and appears as the fourth song on side two of Supertramp’s third studio album of the same name. Personnel on the record were: Rick Davies (vocals, Wurlitzer electric piano, acoustic piano, Hammond organ, synthesizers, harmonica), Rodger Hodgson (vocals, guitar, Wurlitzer electric piano, acoustic piano), John Anthony Helliwell (sax, clarinet, backing vocals), Dougie Thomson (bass), and Bob Siebenberg (drums, percussion).

The album, Crime of the Century, was recorded between February- June 1974 at Trident, Ramport Studios, and Scorpio Sound in London. Produced by Ken Scott and Supertramp, it was released in September 1974. The album went to #38 on the Billboard 200 Albums chart and has been certified Gold by the Recording Industry Association of America. Three singles were released from the LP, including “Bloody Well Right,” which went to #35 on the Billboard Hot 100 Singles chart.

Supertramp were an English rock band formed in London in 1969 by Roger Hodgson and Rick Davies. They were known for blending progressive rock with pop sensibilities which relied heavily on the sound of overdriven Wurlitzer electric pianos. They released eleven studio albums, six live albums, four compilation albums, and 26 singles. Roger Hodgson left the band in 1996, and Rick Davies continued the band with various personnel until 2015, when he acquired some health problems. Nineteen people have passed through Supertramp since its inception. Co-founder Roger Hodgson has released five studio albums since leaving the band and still tours occasionally as a solo artist